Let’s data dive

The Fortune 500 is like the VIP list of the business world, where the United States' largest and most powerful companies strut their stuff based on annual revenue. If companies were celebrities, the Fortune 500 would be the Hollywood Walk of Fame!

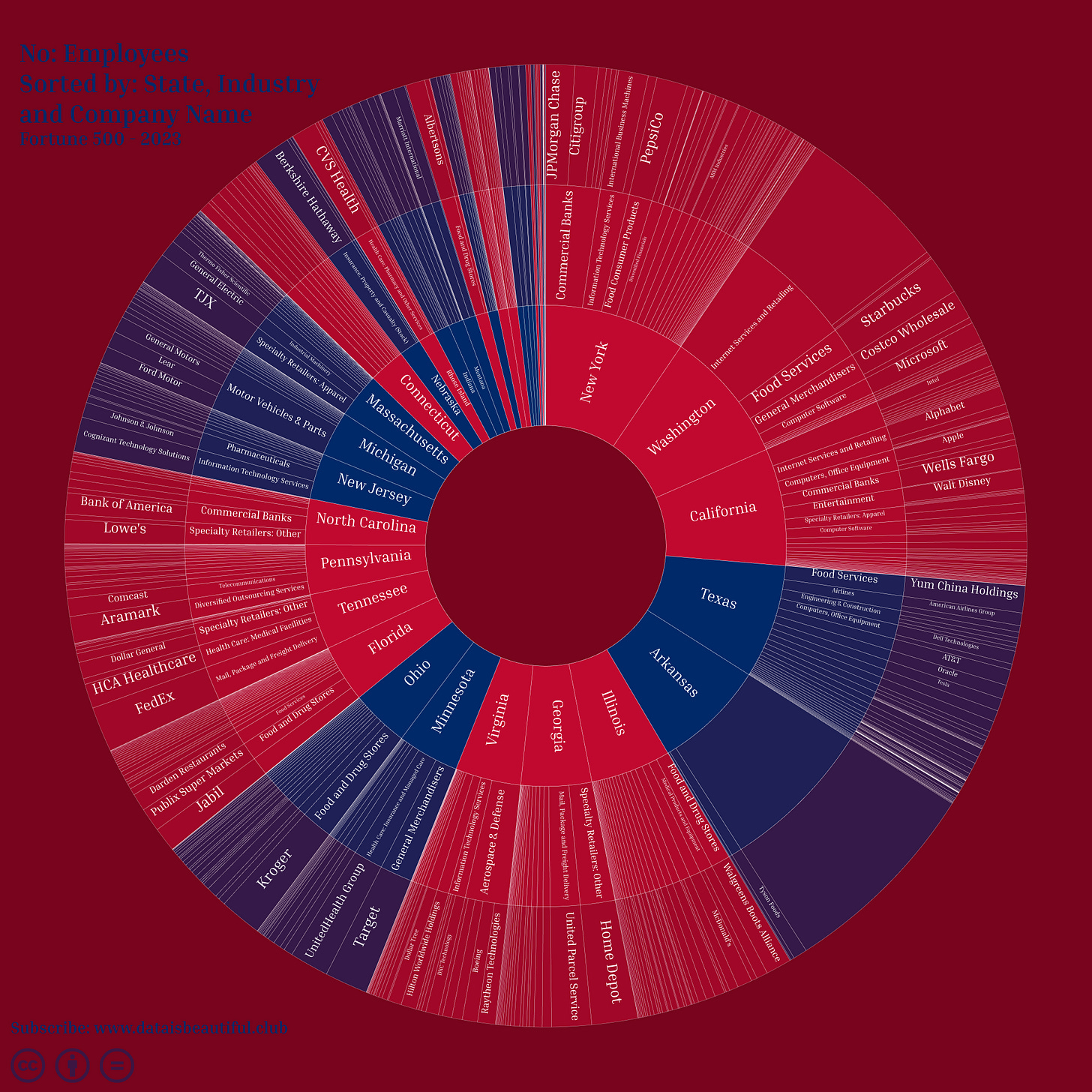

Employee:

The average number of employees across these Fortune 500 companies is around 60,815.

The company with the fewest employees has 381, while the company with the most employees boasts a whopping 2,100,000.

Revenue Mn:

The average revenue is approximately $36.29 billion.

The company with the lowest revenue earns $7.24 billion, while the top earner brings in $611.29 billion.

Valuation Mn:

The average valuation is approximately $69.70 billion.

The minimum valuation is surprisingly low at $54 million. The maximum valuation reaches $2.61 trillion.

Profit Mn:

The average profit is about $3.12 billion.

There's a significant spread in profit, with the least profitable company reporting a loss of $22.82 billion and the most profitable company earning $99.80 billion.

Profit %:

The average profit percentage is 9.39%.

The company with the lowest profit percentage had a negative value of -115.1%, indicating a loss, while the most profitable company had a profit margin of 51%.

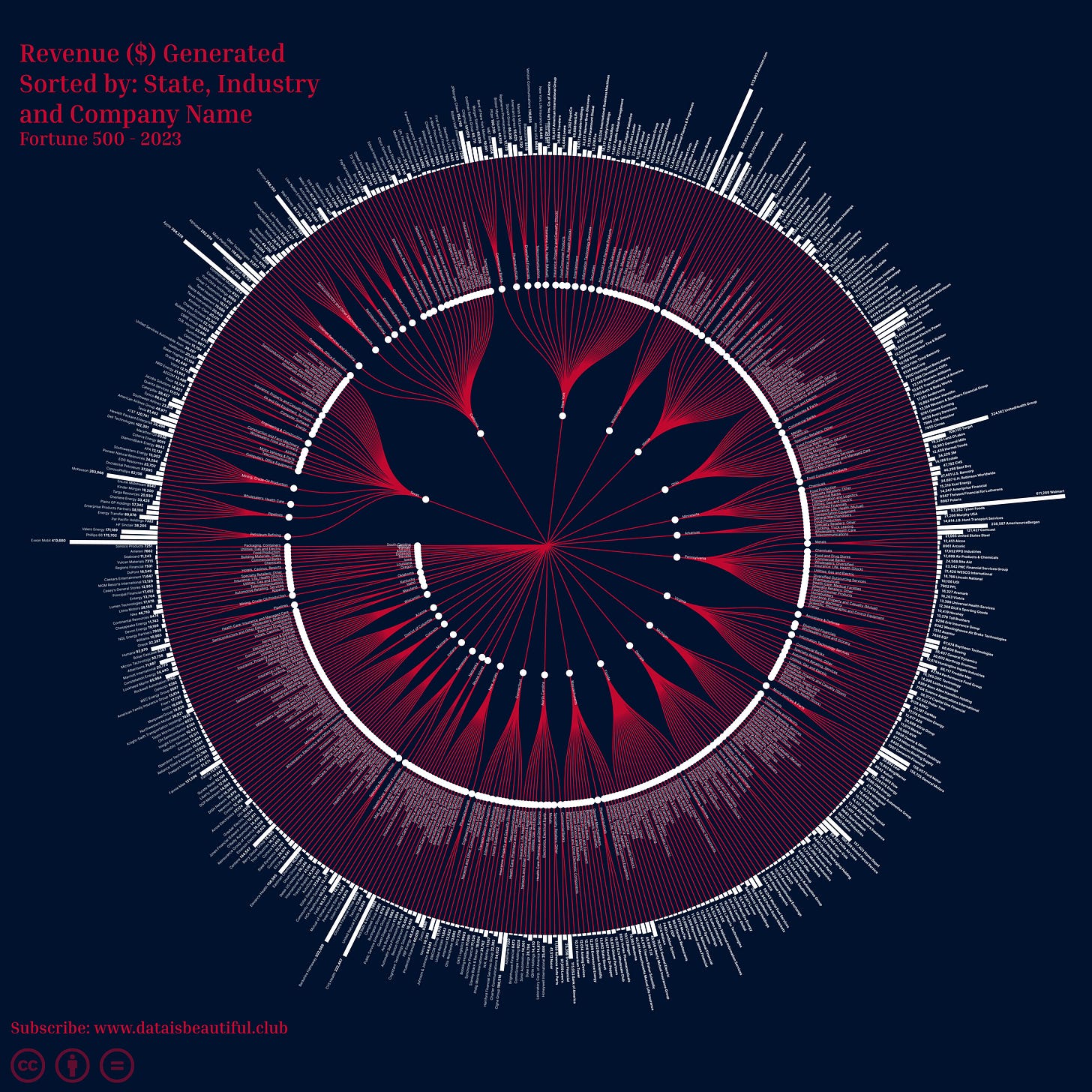

Top 10 companies based on revenue, valuation, and profit.

By Revenue:

Walmart: $611.29 billion

Amazon.com: $513.98 billion

Exxon Mobil: $413.68 billion

Apple: $394.33 billion

UnitedHealth Group: $324.16 billion

CVS Health: $322.47 billion

Berkshire Hathaway: $302.09 billion

Alphabet: $282.84 billion

McKesson: $263.97 billion

Chevron: $246.25 billion

By Valuation:

Apple: $2.61 trillion

Microsoft: $2.15 trillion

Alphabet: $1.33 trillion

Amazon.com: $1.06 trillion

Nvidia: $686.09 billion

Berkshire Hathaway: $675.66 billion

Tesla: $656.43 billion

Meta Platforms: $549.48 billion

Johnson & Johnson: $483.58 billion

Visa: $475.31 billion

By Profit:

Apple: $99.80 billion

Microsoft: $72.74 billion

Alphabet: $59.97 billion

Exxon Mobil: $55.74 billion

JPMorgan Chase: $37.68 billion

Chevron: $35.47 billion

Pfizer: $31.37 billion

Bank of America: $27.53 billion

Meta Platforms: $23.20 billion

Verizon Communications: $21.26 billion

Top 10 industries based on average revenue, along with their average valuation and profit:

Health Care: Insurance and Managed Care

Average Revenue: $150.03 billion

Average Valuation: $132.21 billion

Average Profit: $6.19 billion

General Merchandisers

Average Revenue: $146.52 billion

Average Valuation: $102.03 billion

Average Profit: $3.17 billion

Petroleum Refining

Average Revenue: $144.38 billion

Average Valuation: $103.73 billion

Average Profit: $14.97 billion

Wholesalers: Health Care

Average Revenue: $141.30 billion

Average Valuation: $22.48 billion

Average Profit: $488 million

Health Care: Pharmacy and Other Services

Average Revenue: $108.43 billion

Average Valuation: $48.88 billion

Average Profit: $2.83 billion

Computers, Office Equipment

Average Revenue: $102.46 billion

Average Valuation: $450.56 billion

Average Profit: $17.98 billion

Mail, Package and Freight Delivery

Average Revenue: $96.93 billion

Average Valuation: $111.81 billion

Average Profit: $7.69 billion

Food and Drug Stores

Average Revenue: $86.47 billion

Average Valuation: $19.13 billion

Average Profit: $2.12 billion

Internet Services and Retailing

Average Revenue: $81.76 billion

Average Valuation: $251.53 billion

Average Profit: $5.39 billion

Telecommunications

Average Revenue: $68.12 billion

Average Valuation: $75.72 billion

Average Profit: $3.44 billion

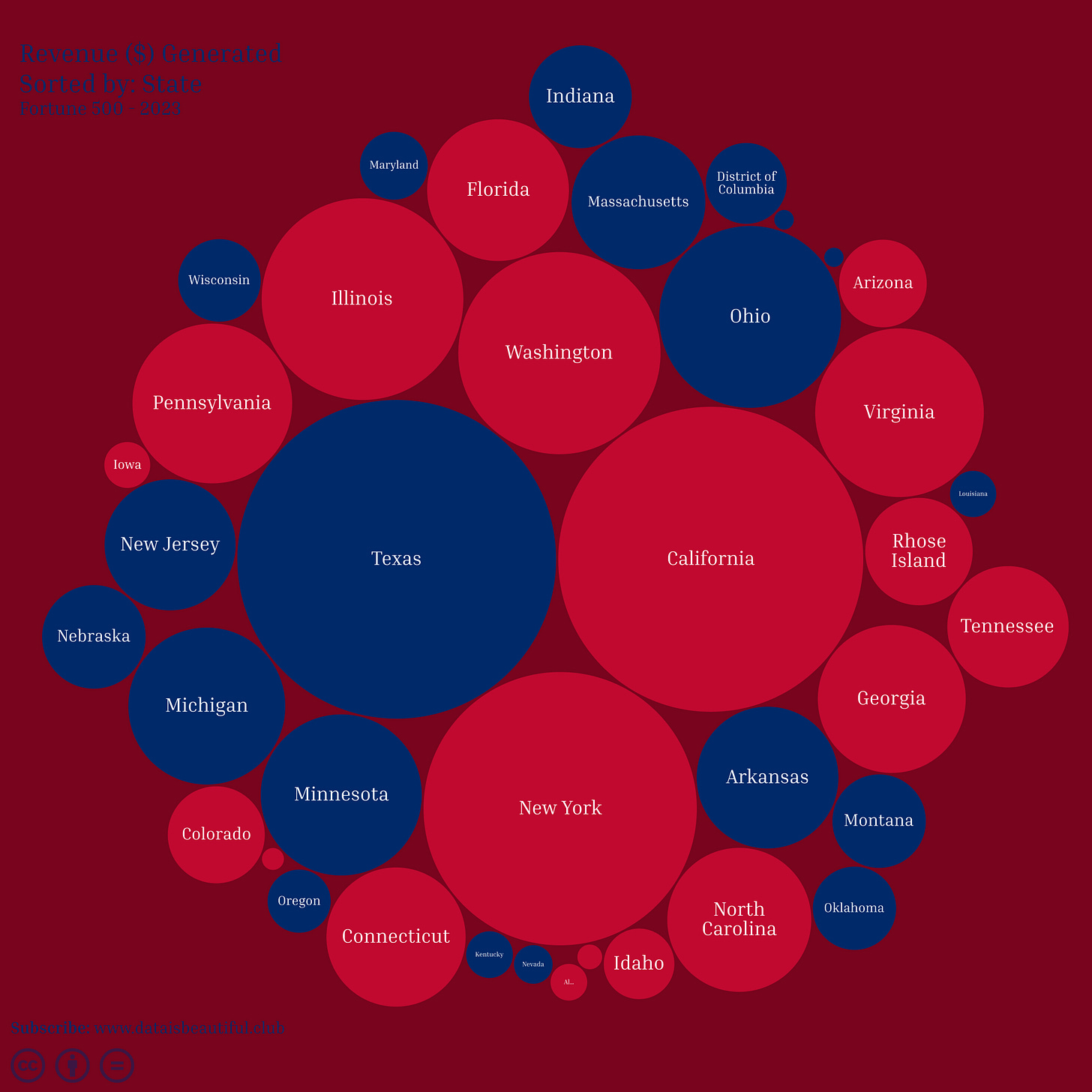

Here are the top 10 states based on the number of Fortune 500 companies:

Texas: 55 companies

California: 53 companies

New York: 50 companies

Illinois: 33 companies

Virginia: 24 companies

Ohio: 24 companies

Pennsylvania: 23 companies

Florida: 23 companies

Georgia: 19 companies

Michigan: 18 companies

These states are major business hubs and have a high concentration of Fortune 500 companies.

Here's the correlation matrix for the numerical columns:

Employee and Revenue: There's a strong positive correlation of 0.69, indicating that companies with more employees tend to have higher revenue.

Revenue and Valuation: There's a positive correlation of 0.57, suggesting that companies with higher revenue often have a higher valuation.

Revenue and Profit: A positive correlation of 0.51 indicates that companies with higher revenue tend to have higher profits.

Valuation and Profit: There's a strong positive correlation of 0.79, meaning companies with higher valuations tend to have higher profits. This makes intuitive sense, as a company's valuation often reflects its profit-generating potential.

Profit and Profit %: A positive correlation of 0.41 shows that companies with higher absolute profits tend to have higher profit percentages.

It's interesting to note that while there's a strong correlation between the number of employees and revenue, the correlation between the number of employees and profit is not as strong. This may suggest that while larger companies (in terms of employees) often bring in higher revenue, their profit margins aren't necessarily proportionally higher.

Thanks for reading