Volatility

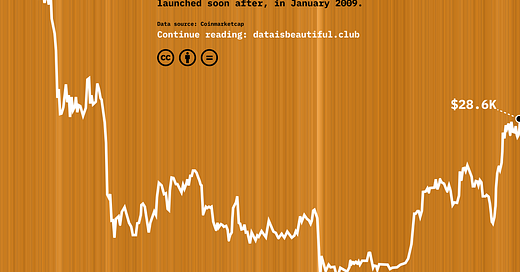

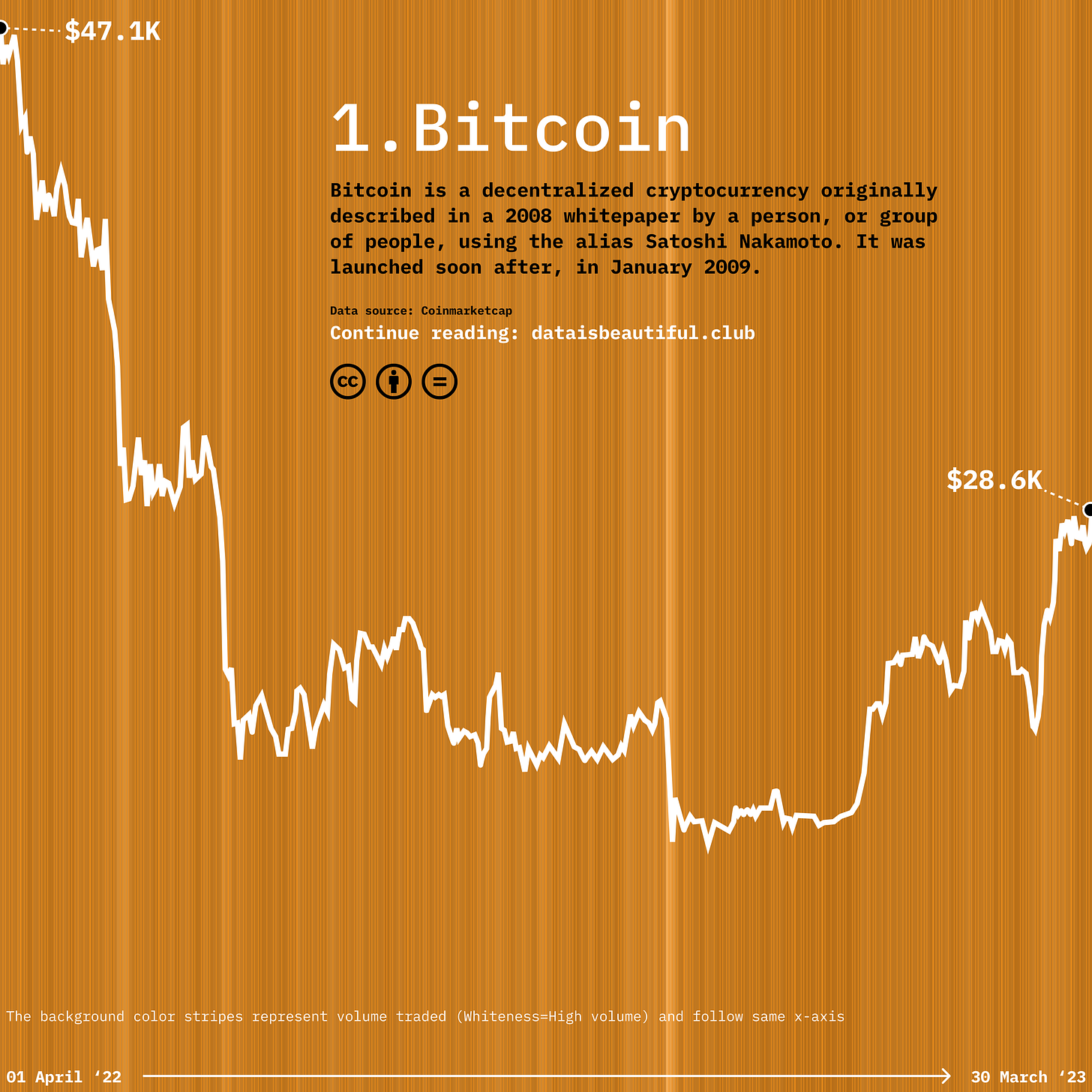

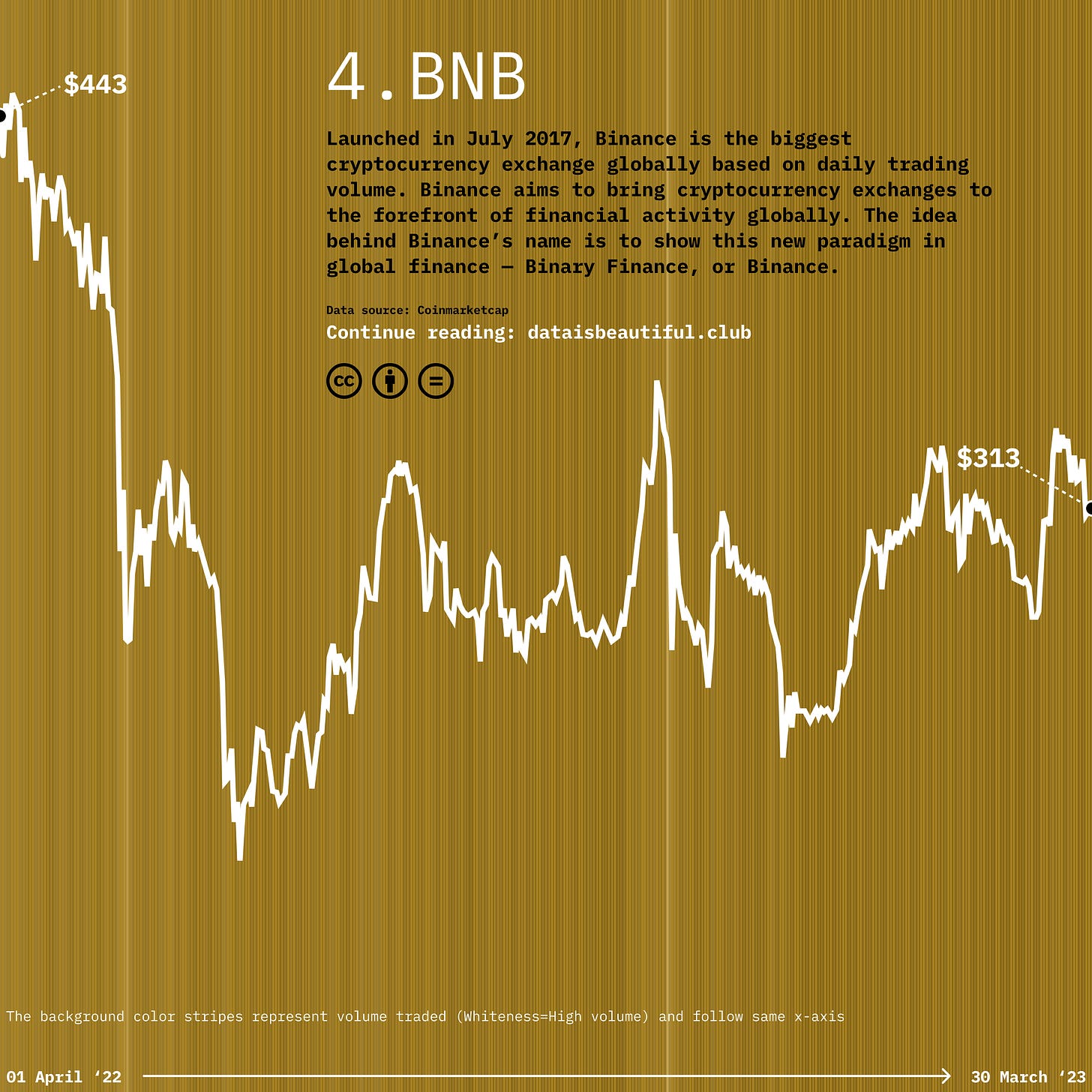

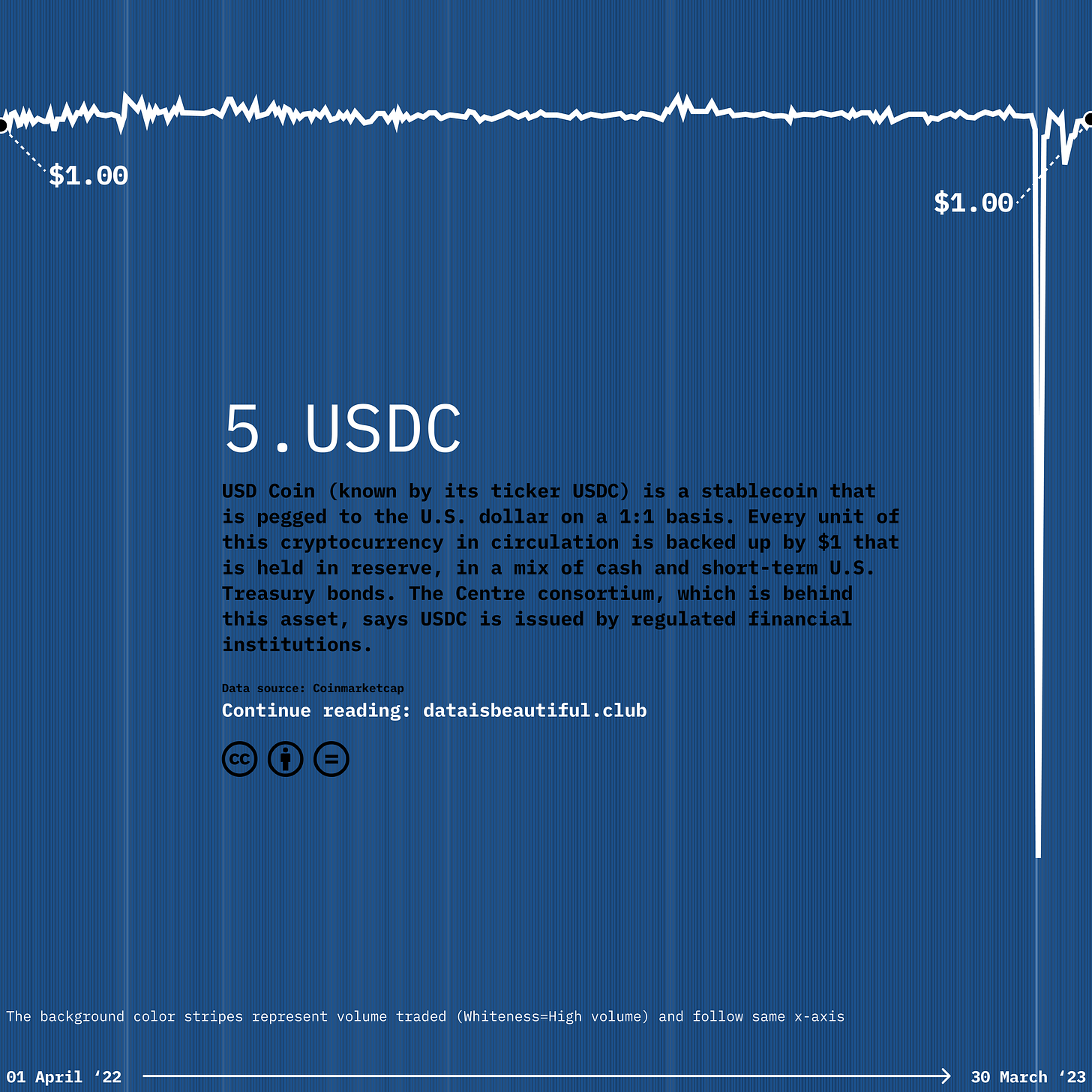

Cryptocurrencies are extremely volatile. Prices can swing dramatically within short periods, which can result in significant financial losses. Unlike traditional financial markets, cryptocurrency markets operate 24/7, meaning that changes can happen at any time.

Regulatory Risks

The regulatory environment for cryptocurrencies is still evolving. Government actions can dramatically affect the price and legality of cryptocurrencies. For instance, if a government decides to ban or restrict the use of a particular cryptocurrency, its value could plummet.

Lack of Consumer Protections

Traditional financial systems have various safety nets in place, including insurance on bank deposits and established legal frameworks for dispute resolution. Cryptocurrencies generally do not have these protections. If you fall victim to fraud or if your digital wallet is hacked, there is often little you can do to recover your investments.

Complexity and Technical Risks

Understanding how cryptocurrencies and blockchain technology work can be challenging. Mistakes such as losing your private keys can result in the permanent loss of your assets. Additionally, if you're using new or less-known cryptocurrencies, you could be at risk due to bugs in the code or network.

Liquidity Risks

While major cryptocurrencies like Bitcoin and Ethereum are relatively liquid, many others are not. If you invest in a less popular cryptocurrency, you might find it difficult to sell your holdings at market value.

Market Manipulation

Cryptocurrency markets are less regulated and can be more susceptible to market manipulation than traditional financial markets. "Pump and dump" schemes, insider trading, and other manipulative tactics are risks that investors must consider.

Environmental Concerns

Some cryptocurrencies like Bitcoin require a significant amount of energy to maintain. These environmental concerns can be a moral issue for some investors and can also affect the long-term viability of such cryptocurrencies if they become subject to regulatory action aimed at mitigating climate change.

Tax Implications

Many jurisdictions treat cryptocurrency transactions as taxable events. The lack of clarity and evolving nature of cryptocurrency tax regulations can make it challenging to comply with tax obligations.

FOMO and Psychological Factors

The Fear of Missing Out (FOMO) can drive investors to make impulsive decisions without adequate research or understanding of the risks involved, leading to financial losses.

No Earnings, Dividends, or Fundamentals

Unlike traditional investments like stocks or real estate, cryptocurrencies do not generate earnings or pay dividends. Investment value is largely speculative and based on market sentiment rather than fundamentals.

Given these risks, it's crucial to do thorough research and perhaps consult with financial advisors who understand both traditional investments and cryptocurrencies before diving in.

Thanks for reading